|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Cash Out Refinance Companies: A Complete Beginner’s GuideCash out refinancing can be a valuable financial tool if you're looking to access your home equity for major expenses. Choosing the right company is crucial for a smooth and beneficial process. This guide will walk you through some of the best cash out refinance companies and what makes them stand out. Understanding Cash Out RefinancingBefore diving into the best companies, it's important to understand what cash out refinancing entails. Essentially, it allows you to refinance your mortgage for more than you currently owe, and take the difference in cash. This can be used for home improvements, debt consolidation, or other significant expenses. Benefits of Cash Out Refinancing

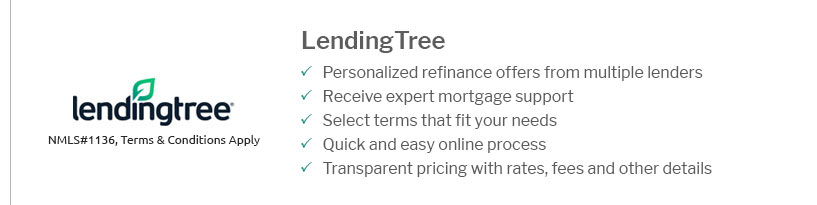

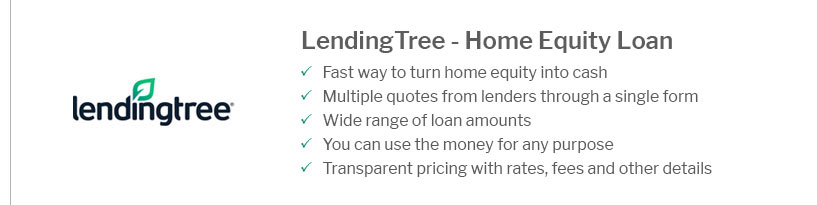

Top Companies for Cash Out RefinancingHere is a list of some of the top companies known for offering excellent cash out refinance services: Quicken LoansQuicken Loans is known for its excellent customer service and efficient online platform. They offer competitive rates and a variety of loan products, making them a popular choice among homeowners. LendingTreeLendingTree is a unique option as it allows you to compare offers from multiple lenders, ensuring you get the best deal. Their easy-to-use platform and personalized offers make refinancing straightforward. Bank of AmericaBank of America provides a wide range of refinancing options with competitive rates. Their extensive resources and strong reputation make them a reliable choice for many homeowners. For more information on how you can refinance 100 percent home value, check out this detailed guide. How to Choose the Right Refinance CompanyChoosing the right company requires careful consideration of several factors:

If you’re struggling with credit issues, you can learn more about options to refinance FHA loan with bad credit to help you make informed decisions. FAQWhat is cash out refinancing?Cash out refinancing is a mortgage refinancing option where you take out a new mortgage for more than you currently owe, and receive the difference in cash. How do I qualify for a cash out refinance?Qualification requirements vary by lender, but typically include having sufficient home equity, a good credit score, and proof of income. Are there risks to cash out refinancing?Yes, risks include potentially higher monthly payments and fees. It’s important to consider your financial situation and consult with a financial advisor before proceeding. https://ficoforums.myfico.com/t5/Mortgage-Loans/Where-to-find-best-deals-lenders-on-a-cash-out-refinance/td-p/6498910

Thank you for this information. I ended up reaching out to a few lenders, and you're right, they were all in the ballpark. One did make an ... https://money.com/cash-out-refinance/

Stay ahead of your finances. Subscribe to our Newsletters. Subscribe. TOP. Categories; Current Mortgage Rates - Best Mortgage Lenders ... https://www.freedommortgage.com/cash-out-refinance

Freedom Mortgage may be able to offer you a rate that is lower or higher than the rate you see advertised by other lenders. Ask us today what cash out ...

|

|---|